|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Senior Pet Insurance: A Comprehensive OverviewAs our beloved pets age, their healthcare needs inevitably evolve, making the consideration of senior pet insurance a topic of growing interest among pet owners. This specialized insurance, tailored for older animals, offers coverage that can help alleviate the financial burden of age-related health issues, but it also comes with its own set of advantages and drawbacks. Navigating the complexities of such insurance requires a discerning eye to balance the cost with the potential benefits. Why, you might ask, should one consider senior pet insurance? The reasons are manifold and nuanced. Firstly, as pets grow older, the likelihood of them developing chronic conditions like arthritis, diabetes, or heart disease increases. These conditions often require ongoing treatments and medications, which can be financially taxing. Herein lies one of the primary advantages of senior pet insurance: it can significantly reduce out-of-pocket expenses for veterinary care. Policies often cover routine check-ups, medications, and sometimes even alternative therapies, providing a financial cushion that can make a tangible difference in the quality of care your pet receives. However, as with any insurance, it's crucial to be aware of the potential downsides. Premiums for senior pet insurance are typically higher than those for younger animals, reflecting the increased risk of illness. Some policies may also have restrictions on pre-existing conditions, which are common in older pets. Additionally, there may be age limits beyond which a pet cannot be insured, a factor that requires careful consideration when weighing the options. Moreover, understanding the fine print is essential. Policies vary widely in terms of coverage limits, deductibles, and reimbursement rates. A policy with a low monthly premium might seem appealing at first glance, but could result in substantial out-of-pocket expenses if the reimbursement rate is low or if there are high deductibles. It’s advisable to scrutinize the details meticulously, perhaps even discussing the options with a trusted veterinarian who understands your pet’s specific needs. On the other hand, some pet owners argue that setting aside funds in a dedicated savings account could be a more flexible and potentially cost-effective strategy than paying for insurance premiums. This approach allows for greater control over how funds are used and eliminates the hassle of dealing with insurance claims and paperwork. Nonetheless, it requires a disciplined savings plan and might not offer the immediate financial relief that an insurance payout can provide in the event of an emergency. In conclusion, senior pet insurance presents a viable option for those seeking peace of mind regarding their pet’s healthcare. It offers a safeguard against the financial unpredictabilities associated with aging pets, albeit with considerations that warrant thorough examination. The decision ultimately rests on individual circumstances, such as the pet’s health history, the owner’s financial situation, and personal preferences regarding risk management. Whether through insurance or alternative financial planning, ensuring that our senior pets receive the care they deserve is a testament to the deep bond we share with them, one that only grows stronger with time. https://www.pawlicy.com/blog/pet-insurance-for-older-dogs/

The good news is that it is possible to pet insurance for senior dogs. We'll go over your options to help you find the coverage your four-legged friend ... https://www.petsbest.com/senior-pet-owners-guide

Bookmark this handy guide. It'll help keep them healthy, and help you receive the maximum amount of purrs and tail wags. https://www.progressive.com/answers/senior-pet-insurance/

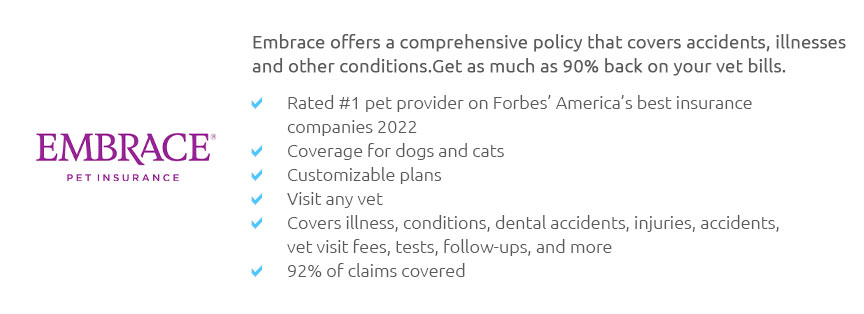

Senior pets may also be excluded from coverage if an insurer has a maximum age limit for new policies. However, Progressive Pet Insurance by Pets Best has no ...

|